💰Liquidity Layer

Liquidity architecture

Aggregator routing taps Somnex V2/V3, QuickSwap, Somnia Exchange, and others for best execution.

AMM liquidity via V2 (full-range) and V3 (concentrated ranges).

Perp liquidity (SPLP) is single-sided USDC; utilization drives borrow fees.

Add Liquidity

Add liquidity through Earn → + Add Liquidity and choose a strategy.

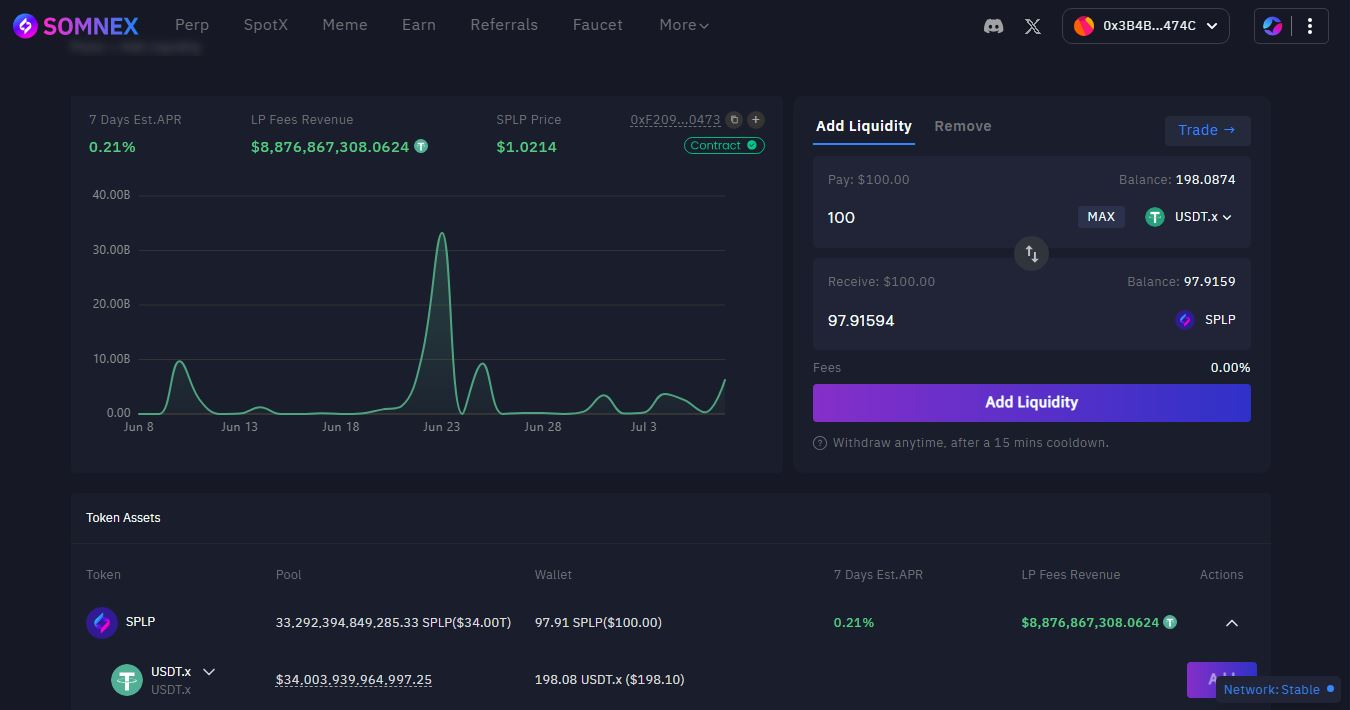

1️⃣ Perp | Stable income pools (SPLP)

Select Perp Pools and deposit USDC.

Review projected APR (driven by trading fees).

Approve and Confirm.

Monitor utilization and APR; withdraw anytime per pool rules.

Perp Pools – Low risk, auto-compounding passive yield via stablecoins:

Designed for low-risk, USDC in / USDC out

Single-sided deposit. no pairs

No Locks, deposit & withdraw any time

Real-time yield distribution — no claims, no extra fees

Rewards come directly from perpetual trading fees

💡 Ideal for users seeking passive income without worrying about impermanent loss.

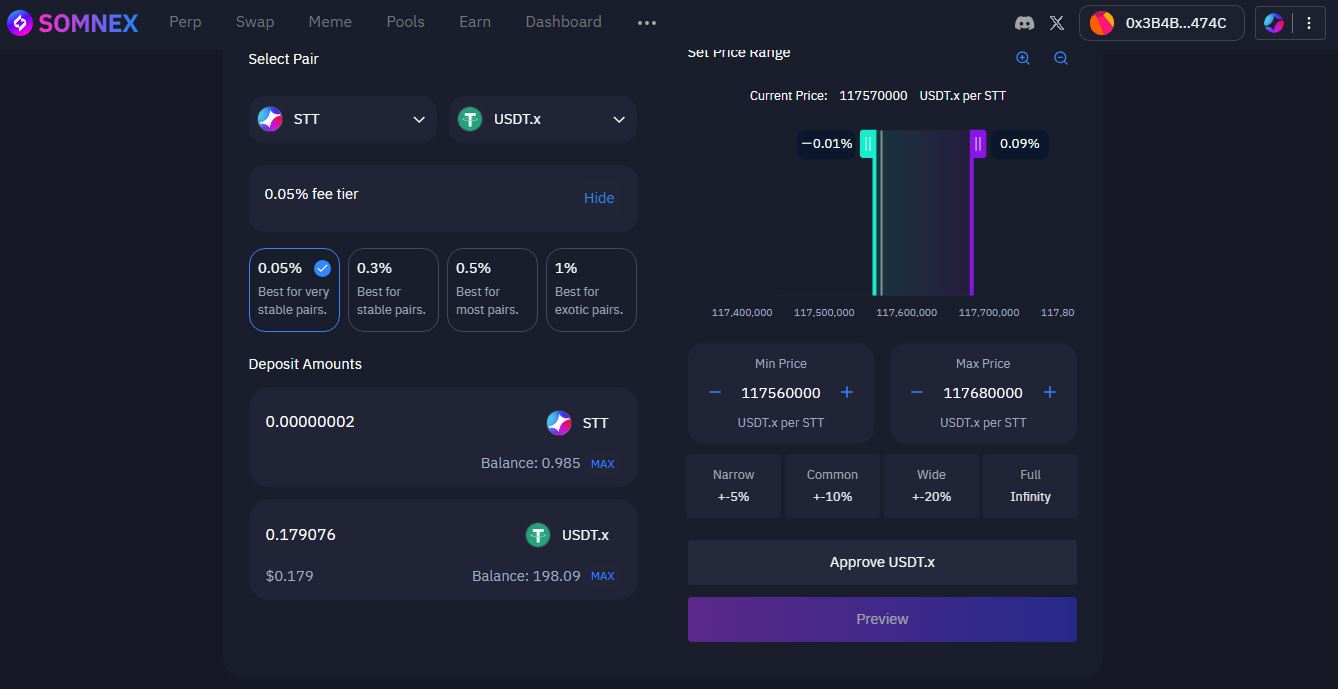

2️⃣ V3 | Concentrated Liquidity Pools

Choose pair & fee tier, then set a price range.

Add token amounts; ensure both sides match required ratio.

Approve and Confirm.

Re-range as needed to keep liquidity active.

V3 Pools – Concentrated Liquidity, Enhanced Capital Efficiency

V3 Pools allow LPs to deploy liquidity within custom price ranges, optimizing fee capture relative to price movement.

Selectable fee tiers (0.05%–1%) depending on pair volatility

Custom price range via tick-based boundaries

Capital-efficient LP provisioning

💡 Ideal for advanced LPs who want to maximize returns through strategic price range selection and are comfortable actively managing positions.

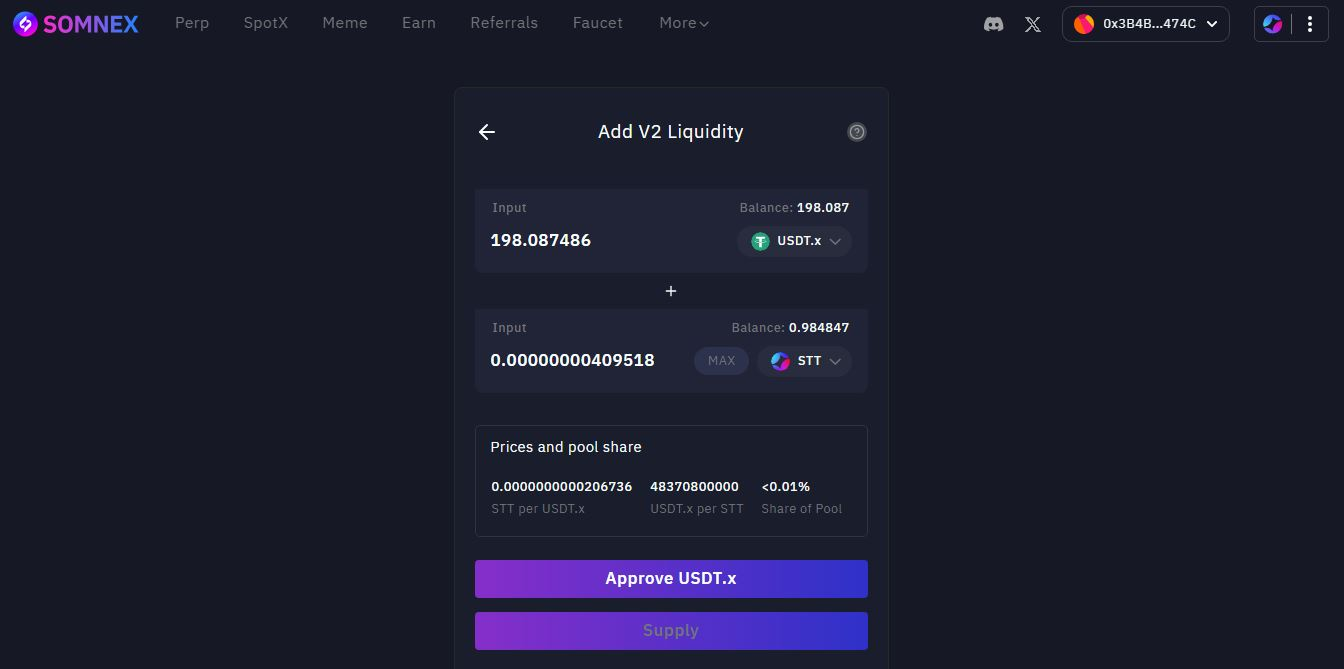

3️⃣ V2 | Volatile Pools

Choose pair and deposit both tokens (50/50 by value unless specified).

Approve and Confirm.

Earn swap fees continuous

V2 Pools – Classic, Volatile Exposure

Traditional AMM pool across Memes and native Somnia tokens

Yield potential increases with volatility

Easy to manage — no need to set custom ranges

💡 Best for users comfortable with market risk and aiming for long-term gains.

Last updated